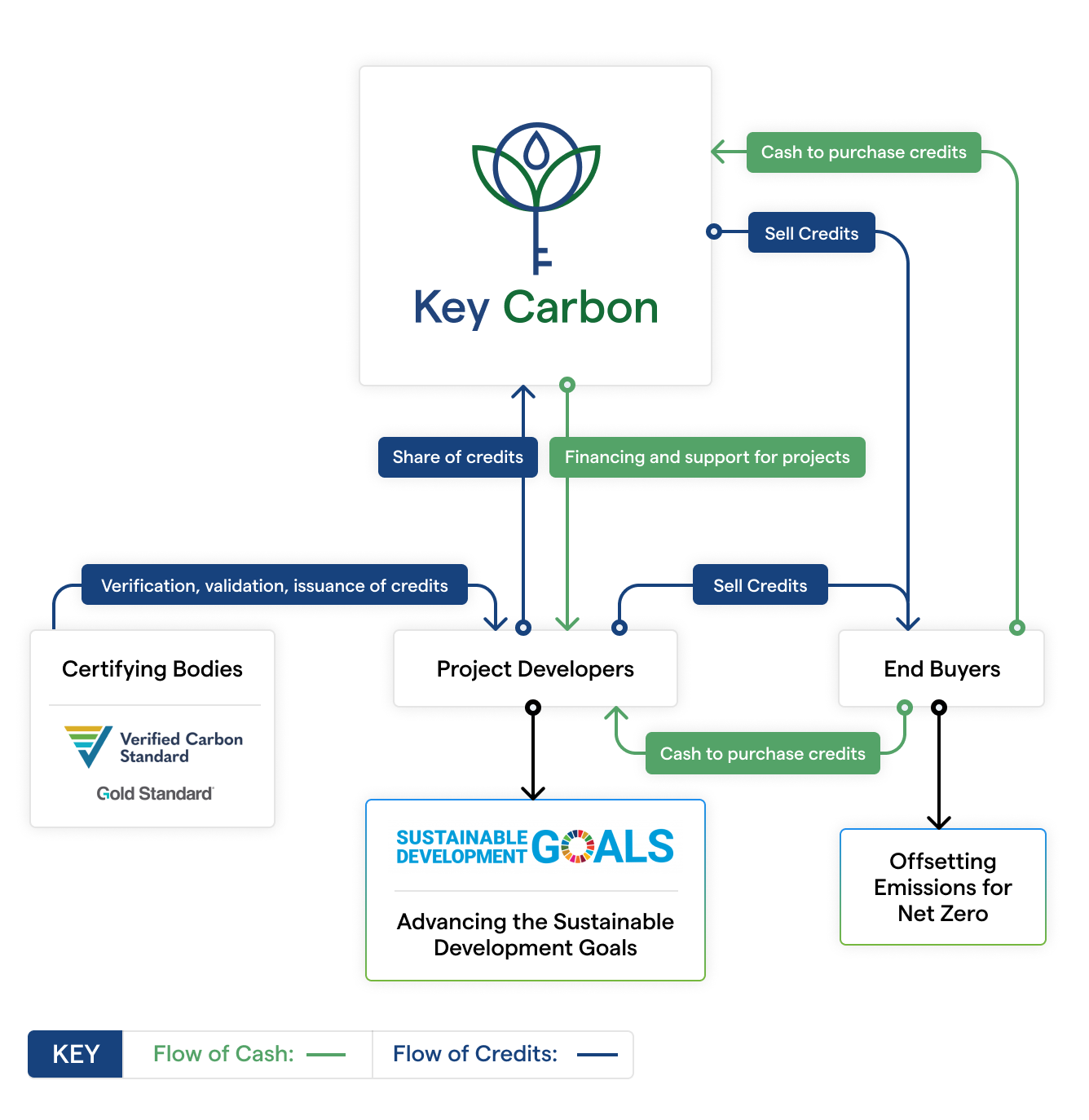

Key Carbon finances and supports some of the leading developers of high-quality carbon projects.

Founded in 2021 as Carbon Neutral Royalty and rebranded as Key Carbon in 2023, we are a permanent capital vehicle building a large, diversified portfolio of high-integrity carbon credit streams and royalties. Corporates and other entities can purchase our Voluntary Carbon Credits to help them achieve their climate and sustainability goals. Our aim is to help combat climate change while also improving local biodiversity, soil health, water quality and benefitting vulnerable communities.